As the market is heating up for attracting and retaining diverse and talented directors, private companies are reviewing their director compensation levels in order to remain competitive. To help private companies benchmark program costs, Private Company Director teamed with Compensation Advisory Partners (CAP), an independent compensation consulting firm, to conduct the 2021 Private Company Board Compensation Pulse Survey, which updates and expands the data we captured in 2020.

Among the key findings from the pulse survey:

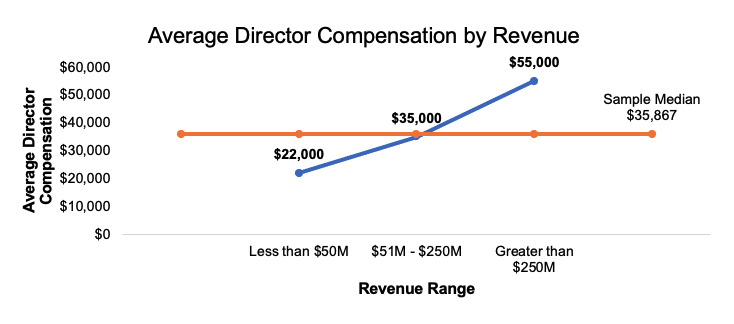

• As expected, compensation varies by company size. Individual director total compensation is more than $35,000 at median for all respondents. Total compensation includes retainers, meeting fees, equity and any other forms of compensation.

• Total board compensation cost is $150,000 at median or 0.13% of company revenues.

• Board operations and structure and compensation programs are transitioning to normalcy after the COVID-19 pandemic, with some changes planned for 2021.

• Board priorities continue to focus on the key responsibilities of strategic planning, financial management and succession planning.

Demographics of survey participants

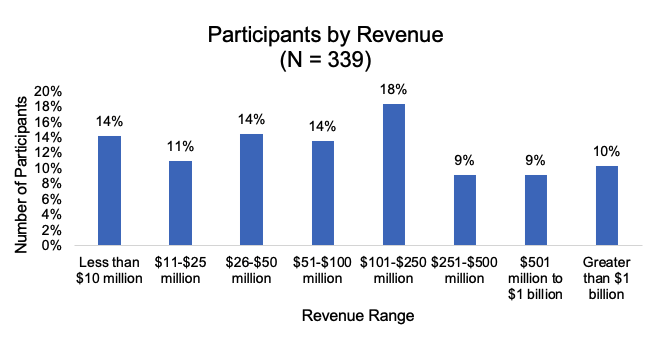

More than 300 companies responded to the 2021 Private Company Board Compensation Pulse Survey, which was an abbreviated follow-up survey to the popular Private Company Board Compensation and Governance Survey conducted in 2019 and 2020 by Private Company Director and CAP. The companies represent a broad range of industries. Manufacturing is the most prevalent industry in the survey (26% of respondents), followed by professional, scientific and technical services (14%) and finance and insurance (12%). Most of the respondents are family-owned or -controlled companies and have fiduciary boards.

The survey drew responses from companies of varying sizes. (See Chart 1 on facing page.)

Director compensation levels

The survey asked participants to provide compensation data by component (e.g., cash compensation, long-term incentives, all other compensation) and in total for all directors. Each element of total compensation was assessed individually.

Director compensation continues to be delivered primarily in cash (92% of survey respondents). Only 21% of survey respondents provide directors with long-term incentive (LTI) compensation, which is delivered through real or phantom equity or long-term cash bonuses. Data is not additive across the pay components because of the varying prevalence of cash, long-term incentives and all other compensation.

The median total compensation level for the total data sample is $35,867. Total compensation levels are correlated with company size.

Board leadership is recognized through additional compensation. Both the board chair and lead/presiding director roles merit pay premiums relative to compensation for directors not in board leadership roles. Of the respondents, 55% reported compensation data for the board chair role, while 24% reported data for a lead or presiding director.

Total cost of governance

The data provided by survey respondents allowed CAP to calculate the total cost of governance, which is the sum of total compensation for all directors, both on a dollar basis and as a percentage of revenue. The median cost of governance is $150,000. As a percentage of revenue, the median cost of governance is 0.13%. While governance costs increase on a dollar basis for larger companies, the governance costs as a percentage of revenue decrease with company size.

Governance trends

The survey asked about changes to board structure and operations and to board compensation programs for 2021. A quarter of respondents indicate that their boards are increasing the total number of directors and the number of independent board members. Private companies are actively seeking to add directors who bring unique skill sets, professional connections, differentiated experience and diverse perspectives. Chart 6 summarizes board structure and operational changes for 2021.

Respondents were questioned about board compensation changes. The most notable changes are being made to annual retainers: 7% of respondents will add annual retainers, while 13% will increase the amount of the retainer. Similarly, 8% of respondents plan to add board chair or lead director pay components in 2021; and another 7% will increase the amount of this incremental pay.

Survey participants were asked to select the top three priorities for the board in 2021. Corporate strategy was the overall top priority, selected by more than 250 companies, followed by financial stability/cash flow and succession planning. Although environmental, social, and governance (ESG) initiatives have received substantial attention in recent years, board diversity, company diversity and climate / environmental issues were the priorities selected least by respondents.

The results indicate that private company boards continue to remain focused on the key requirements of running the business, namely strategic planning, financial management and succession planning. All other areas are viewed as secondary to focusing on the business basics.

Bertha Masuda, Bonnie Schindler and Susan Schroeder are partners at CAP.